Home insurance (apartments, houses and villas) - instructions on how to insure an apartment or a country house against fire and flooding + TOP-7 companies where it is profitable to buy insurance

Hello dear readers of the magazine Rich Pro. Today we will talk about home insurancenamely, what is the insurance of an apartment or a house for, what does the insurance of suburban residential real estate protect against, and so on.

This topic is not new, but it is becoming increasingly relevant now. The high economic value of the property makes real estate a sought-after insurance object.

In this publication you will learn:

- Why do you need to insure housing;

- What makes up the cost of insurance of an apartment, house (cottage) - the main factors that affect the price of insurance;

- What methods, conditions, types of real estate insurance exist.

We also pay attention to the misconceptions that are associated with insurance and answer frequently asked questions.

This article will arouse interest among a wide range of readers who own or intend to acquire real estate. Therefore, do not hesitate to familiarize yourself with it in order to calculate possible risks and draw timely conclusions.

Why do you need home insurance, how is the apartment insured against fire and flooding of neighbors, and how to insure your home (apartment or house) profitably - read in this issue

Why do you need home insurance, how is the apartment insured against fire and flooding of neighbors, and how to insure your home (apartment or house) profitably - read in this issue

1. Why do you need insurance of an apartment, house or cottage ☂ 🏠

Protection of real estate is the main criterion for its proper use. You can protect your property with high fences, strong doors and locks, installation of security systems and bars on the windows.

But it is impossible to foresee all natural disasters, the onset of which does not depend on the owners. It goes about fires, flooding, causing other damage to real estate. Insurance will help compensate for damage from loss and damage to property.

Home insuranceIt is a universal property protection measure for private and legal entities in the event of an insured event. Its economic nature is the formation of an insurance fund through contributions, which is intended for payments, upon the occurrence of conditions specified in the contract.

In the Russian Federation is subject to compulsory insurance only health of citizens and vehicles. All other types are voluntary, but real estate needs no less protection, its value is higher than that of vehicles, and the damage may cause big problems.

Especially, this applies to real estate, which is visited by owners irregularly - cottages, country houses. The risk of damage to private households is higher than apartments.

The practice of Western countries suggests that the insurance system should work in all areas of life, including in the real estate market. Abroad, insurance policies are available to all owners and managers of real estate.

The USSR also had a compulsory insurance system. residential buildings, summer cottages, farm buildings, she stopped working due to the collapse of the state. The unstable economic situation in the country, the decline in the living standards of workers made the insurance system inaccessible to most owners.

Statistics provide evidence that in the overall market structure the private property insurance segment is less than 5%. This amount includes compulsory insurance when issuing a mortgage, otherwise the amount would be even lower.

Citizens often hope for "maybe", they hope that nothing will happen to property. Insurance premiums do not belong to obligatory expenses from the budget, thereby exposing themselves and their family to the risk of being left without a "roof over their heads".

But modernity dictates new rules. Today's owners of expensive homes and apartments understand that the amount of insurance premiums is much lower than the amount of possible damage. This is only a monetary expression of losses, but how many unrest, worries will a natural disaster take away from the owner of the property? Therefore, over the past years, the insurance market has a steady upward trend.

For example:

The owner of a newly built private house, having arrived to check his property, saw how a strong wind knocked a large tree onto the roof of the house. The roof had to be rebuilt at the expense of their own savings, postponed for the long-awaited family vacation abroad. With an insurance policy, the situation would not be so critical.

Even in the absence of free cash, you should be aware that possible investments in damaged property will at times exceed insurance premiums. Insurance will help protect not only the money, but also the health of the owner.

The main risks that the insurance system protects are:

- Loss of property due to fires, gas explosions, etc.

- The consequences of flooding of houses in connection with floods, apartments due to old utilities.

- Fall on the roof of heavy objects (trees, poles).

- Interior decoration, utilities, plumbing.

- Robbery, burglary.

- Damage to the supporting structures due to shrinkage of the house.

- Responsibility to neighbors for damage caused.

- Protection against damage to rental housing.

- Natural disasters (strong wind, lightning, etc.).

- Illegal acts, for example, hooligan acts and vandalism.

Owners of private households may have additional risks:

- When the house is located near the highway, it is possible to enter the vehicle's house.

- Stove heating, the presence of a bath.

- Damage to the facades of the building.

2. The main types of home insurance - TOP-5 popular insurance objects

In order to develop the services market, insurance companies are developing a variety of kindsand conditionsinsurance. Objects can be both immovable and movable property of citizens.

Clients themselves choose the company and the necessary package of services, in accordance with individual requirements.

The main objects of real estate insurance (private households, apartments, etc.) include:

1) Structural elements

Structural elements (supporting structures) of real estate are interconnected parts of the building and are the main part of the total cost of housing.

These include:

- Roof, walls, foundation.

- Partitions, jumpers, construction sites.

- Hatches, landings, vestibules.

These designs have a suspended risk only in seismically hazardous areas, for other citizens, due to minimal risks, insurance tariffs are negligible.

2) Interior decoration and engineering equipment

To the interior decoration carry window constructions, door leafs, built-in furniture, flooring, wall decoration and the ceiling.

As part of engineering equipment - gas pipeline, heating, water pipes, sewerage, Electricity of the net.

All of the above objects have an increased risk. They are the first to suffer during fires or flooding. And everyone was surely faced with the flow of pipes.

Such insurance is desirable after an expensive repair, to avoid unpleasant situations in the future.

3) Home Property

The concept of home property unites the whole environment indoors. These are the furniture, jewelry, personal items, antiques, computers, etc. that are owned.

They are insured against theft, damage, gulf, fires, mechanical stress.

4) Civil liability

Civil liability implies liability to neighbors for causing damage to them. In case of fire, a pipe break, not only the property of the insured, but also the neighbors may suffer.

The victim will have to restore, in addition to his household, the property of neighbors. This causes a lot of controversy and controversy. You can protect yourself with liability insurance.

For example:

Before work, a washing machine was turned on, so that in the evening there was ready-made clean linen. As a result of a hose breakdown, a water leak has occurred. The neighbors from the bottom were flooded. In the evening, instead of clean linen, disassembly with neighbors is obtained, additional cash costs for the restoration of their repair and repair of their own unit. If there is an insurance contract, the problem will be solved. quickly and painlessly.

Typically, civil liability is an additional insurance object to the main contract, while the increase in the insurance amount occurs slightly.

5) Title insurance

Title insurance - this is protection against possible material losses of the acquirer of real estate, if there is a loss of ownership of him.

This type is necessary when concluding an agreement on the acquisition of expensive property. For example, when drawing up a mortgage agreement.

Insurance, as a rule, applies to the acquisition of housing in the secondary market. About what you need to know when buying an apartment, we wrote in this article.

Credit institutions also insist on title insurance to reduce potential risks in the event of "unclean"transactions when concluding a mortgage agreement.

With a long chain of transactions with real estate (apartments, houses), in the event that at least one of them is not eligible, entails the nullity of all transactions (subsequent sales contracts).

For example: Acquisition of housing, which will subsequently be claimed by close relatives of the seller, who have the right to a share and who did not refuse it in the process of concluding a contract of sale.

If the seller was not authorized to conclude a contract for the sale of real estate, the interests of minors or legally incapable property owners may not be taken into account.

This type of protection guarantees the buyer a return on investment, when events occurleading to the invalidity of the insurance contract:

- The illegality of the contract of sale.

- When making a transaction by an unauthorized seller.

- The fraudulent nature of the transaction.

To date, the most popular program is the insurance of a mortgage apartment. Credit institutions present a mandatory requirement for real estate insurance, which is issued to the bank as a pledge. This is a long term insurance, valid until full repayment of the loan and removal of housing burden.

In more detail about the conditions of the mortgage, we wrote in the article - "What is a mortgage loan", which described how to calculate a mortgage and which mortgage programs are most popular.

A feature of mortgage insurance is a gradual decrease in the cost of the policy when repaying loan debt. Housing is insured for the remainder of the debt. The average tariff is 0,15% from the insured amount. If the cost of an apartment 3 million rubles, the maximum insurance along with the title will cost 15 thousand rubles in year.

3. The cost of home insurance (cottages) - 5 factors that affect the price of insurance of a country house

Life consists of accidents, it is impossible to protect oneself from all troubles. You can only try to reduce risk of their occurrence.

Private households are now objects in which not small material resources are invested. Their loss can lead to serious material and moral consequences. The presence of insurance will protect the owners from a nervous breakdown, will adequately accept the situation.

The price of home insurance depends on many factors:the choice of the insurance company and the type of protection, the size of the house and land, the cost of ownership, etc.

Consider the main circumstances that determine the cost of real estate insurance in more detail.

1) The volume of insured risks

You can insure your home against the following risks:

- Fire.

- Flooding.

- Gas explosion.

- Falling objects (pillars, trees).

- Natural disasters (wind, lightning, flood, etc.)

- Damage.

- Illegal actions (penetration, theft, damage to property).

In addition to the main ones, there are additional risks that are determined for a particular home. They depend on its location, the fears of the owners.

For example, You are afraid to suddenly run out of the house and stay on the street without keys near the closed door. The insurance company will relieve you of fear by reimbursing the cost of a broken door.

Insurance is possible both for all cases and for individual risks. The cost depends on the number of selected items and the percentage of probability of their occurrence.

2) How is the house exploited

Residential buildings are built both for permanent residence in them, and for periodic operation. When visiting the house only on weekends, the risk of penetration or deterioration of the home, the presence of other factors leading to an increase in the tariff increase.

The state of operational systems (gas pipeline, water supply, electrical networks) is also a determining factor for the cost of the policy.

3) The presence of an alarm and protection system from fires, floods, etc.

To ensure protection against burglaries and fires in the household, the owners install an alarm system, surveillance cameras.

The presence of these factors convinces the insurance company that the owners are not indifferent to the condition of the home, so the amount of commission is reduced.

4) The cost of materials (construction and decoration)

The cost of insurance depends on the type of house: wooden, brick, block, the level of its decoration, the status of the home. The more expensive construction materials, repairs, the higher the commission.

5) The term of operation and condition of the country house / house

Old houses / cottages have increased risks, so the cost of the insurance commission is usually higher.

Insurance companies often set a deadline for the operation of a building for the possibility of its insurance - up to 50 years old.

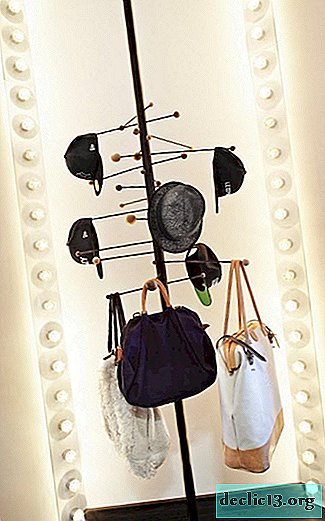

Detailed instructions, where the steps are written how you can quickly insure your apartment, house or cottage

Detailed instructions, where the steps are written how you can quickly insure your apartment, house or cottage

4. How to insure an apartment, house or cottage in 5 steps - step by step instructions for beginners

Knowing the features and the process of concluding a contract, your own home will be insured simply.

Insurance companies exist at the expense of fees charged, so they are interested in offering maximum risk protection for housing.

The owner must adequately analyze and choose acceptable types of insurance.

Agents may offer to insure the home without inspecting it on the spot. They offer a standard contract, a ready-made insurance package, based on the market value of housing.

The cost of such transactions often includes completely unnecessary services that simply increase commissions.

The best option is conclusion of a contract after a full inspection of housing and definition of specific insurance objects.

Good to know!

In large cities (Moscow, St. Petersburg, etc.), there are insurance systems in the city's housing sector for targeted financial support to families. The transaction is concluded at preferential rates, which are paid together with communal receipts.

To be sure of protecting your own apartment, house or cottage, you need to go through several steps.

Step number 1. Analysis of insurance companies

You must choose an organization that works stably in the market, values its customers, pays reimbursements without delay and red tape.

Most of these companies, but there are unscrupulous organizations that put in the forefront their benefits from the transaction.Turning to them, you can be left without full or even partial reimbursement of insured risks.

The main criteria for choosing an insurance agency:

- Total work experience in the financial market.

- Company rating in large agencies.

- Solvency and stability of the organization.

- Economically sound tariffs.

- The presence of special programs.

- Reviews about the company of acquaintances, on thematic forums, official sites.

Of course, reviews play a subjective role in the choice, but give a general idea of the company, attitude to customers.

Schematically, the main selection parameters are presented in the table:

| № | Name | Indicators |

| 1. | Work experience | It is better to choose an organization that has been in the financial market for at least 5-6 years. |

| 2. | Rating | There are special agencies that provide an objective rating of all insurance companies by type of insurance, collected premiums, payments |

| 3. | Presence of representative offices, branch network | The larger the company’s network, the more stable its financial situation. |

| 4. | Solvency | The presence of a guarantee fund, the amount of payments for insured events. These data are presented on the official websites of companies. |

| 5. | The presence of special programs, promotions | The greater the variety of services offered, the higher the status of the company, its reliability. Seasonal promotions will help reduce the cost of the service by almost half. |

| 6. | Reviews | Thematic forums can give an idea of the organization from specific clients. Important take into account the presence of positive and negative opinions. |

The more good the insurance company has good indicators, the more reliable it is.

Step number 2. Choice of insurance risks (partial or batch)

The total cost of the service depends on the number of risks, therefore it is not always worthwhile to purchase a full package of all services, even if it is offered "at a discount".

The best option is to choose the most possible risks applicable to a particular housing. Ultimately, this will lead to a lower commission.

For example, the cottage is insured only against theft and hacking. As part of movable property, only the most expensive and rare things are insured.

Step number 3. Submission of documents to the insurance company

The following must be submitted to the insurance company package of documents:

- Proof of identity and registration of the client;

- Certificates of ownership of the apartment, house, cottage, land;

- Technical passports for real estate;

- Valuation from an appraisal company (sometimes companies make valuations on their own);

- When insuring a mortgage apartment - a loan agreement.

To maintain competitiveness, organizations are interested in customers, so the set of documents is minimal; each property owner has it.

Step number 4. Property inspection agent

To save your own money, it would be better to invite an agent for a personal inspection of the property in order to identify possible risks. He will establish the estimated value of the property, tell in detail about the availability of individual insurance programs, promotions and bonuses.

If you make insurance without leaving the place, you will have to pay more, and the amount of coverage for the risks that may arise may be unexpectedly small.

Step number 5. Conclusion of an agreement

To save yourself from surprises, you must carefully study the terms of the insurance contract, all items printed in small print.

One must be sure that upon the occurrence of an insured event, the indemnity will be full and urgent.

5. How much does insurance of an apartment and a country house (summer house) cost стоит

The total amount of insurance is individual, it depends on many factors and the risks chosen by the owner.

Main factorsdetermining the price of insurance of an apartment or house are:

- Market value of home ownership;

- Housing dimensions: its area, number of storeys (for houses);

- How many risks are chosen;

- Term;

- The amount of compensation (selected independently).

The cost of insurance of a country house can be from 2 thousand rubles, apartments 3-5 thousand rublesprivate house - 3-10 thousand rubles in year.

To the features of individual home insurance applies the fact that these objects are insured entirely. It is impossible to insure just the interior decoration of the house. This leads to a rise in the tariff. The average home insurance rate is up to 0.3% from the cost of housing.

There are factors that increase the basic rate: if the house has wooden floors, the rate increases by 0.1%, the presence of stoves and fireplaces increases insurance from 0.2%, periodic residence in the house also increases the basic rate by an average of 0.1%.

Important! Reduced insurance can be with good security at home, the presence of alarms, strong doors, bars on the windows.

Property is insured separately, insurance is up to 4% its value.

For example: Insurance of a wooden house with a stove, the market value of which is 6 million rubles. will be about 60 thousand rubles. per year at the base rate.

6. Where to insure an apartment and a house on favorable terms - TOP-6 + 1 insurance companies with favorable offers

We suggest that you familiarize yourself with the rating of insurance companies that provide apartment and home insurance services.

According to the rating of Expert RA agency, the best companies for home insurance rated "A ++" are:

| № | Name | Number of regional representative offices, branches, departments |

| 1. | Rosgosstrakh | 3000 |

| 2. | VSK | 840 |

| 3. | RESO guarantee | 800 |

| 4. | Alpha Insurance | 300 |

| 5. | Ingosstrakh | 182 |

| 6. | Max | 88 |

+ insurance services from the bank "Sberbank"

Consider each insurance company and its home insurance services in more detail.

1) Rosgosstrakh

It has the most extensive network, has been operating in the financial market for over 88 years. It has its own loss settlement centers, which provide legal and psychological assistance to people in difficult situations.

Among the popular programs are voluntary insurance of a house, apartment, other property, title, etc. It is possible to provide on-line services.

Popular residential property insurance programs include:

"ROSGOSSTRAKH House" ACTIVE " - insurance of typical private houses, which are located in villages, villages, gardening comrades. Basic risks (fire, flood, explosion, illegal actions of third parties, collision of a vehicle, natural disasters) for 1 year are insured.

"ROSGOSSTRAKH House" Prestige " - insurance of elite houses.

Fixed Asset - insurance of interior decoration, engineering equipment, property and civil liability of apartments.

This type of insurance protects the risk of fire, flood, theft. The tariff is individual for each object. Average insurance cost from 5 to 6 thousand rubles.

Individual Asset - implies the inclusion in the package "Asset Fixed" of additional risks: structural elements, exterior decoration.

2) VSK Insurance House

He has been working in the financial market for 25 years. Insurance services for apartments, houses and other residential real estate are at the priority level of the insurance company.

Popular insurance programs:

- Express insurance for the holidays - inexpensive short-term insurance.

- Turnkey - the main package.

- Maximum protection - advanced package.

- Apartment insurance for rent.

- Protection of property damage to neighbors.

- Investment apartment - insurance conditions for customers. Awaiting sale of housing.

Valuation of property is carried out by the company for free, you can pay the tariff by installments.

It is possible to take out insurance for an apartment, house or cottage on-line.

3) RESO-Warranty

25 years of work in the financial market. Here you can make insurance of an apartment, cottage or house from fire and flooding.

Popular program "Brownie", with a different package of risks: Premium, Express, Economy, Preferential.

Program "RESO HOUSE"provides protection for country houses, cottages, land, apartments.

For example, with home insurance worth 6.5 million rubles. (basic risks), insurance will rise 19.6 thousand rubles, fence insurance for 150 thousand rubles. will rise to 0.6 thousand rubles.

Liability insurance and mortgage insurance.

Member of the All-Union Union of Insurers, Russian Union of Auto Insurers, etc. Here you can, if necessary, insure a car or any other movable property.

Currently, the company is working to reduce tariffs. Service cost reduced on 10%.

4) Alpha insurance

It has been working for more than 10 years. It is one of the five leaders in the open insurance market, the All-Union Union of Insurers.

The leader in the ranking of customer service quality.

Popular programs:

- Repair insurance.

- Protection of neighbors.

- "Although the Flood" (a comprehensive package of risks - values, repairs, decoration, civil liability).

- Calm

It is distinguished by a quick payment of insurance claims; you can purchase a policy online.

5) Ingosstrakh

It has been working for over 70 years. It is a high financial stability rating with a Positive outlook. Provides over 20 insurance programs.

Popular residential property insurance are:

- Platinum - a complete package for a period of 3 months.

- Holiday - a short-term policy.

- Freedom.

- Express - economical insurance.

There are representative offices in the countries of near and far abroad.

6) Max

He has been working in the insurance market for 25 years. It offers a maximum of options for real estate insurance: apartments, houses and other real estate, liability, property rights. There are no payment restrictions on the elements of the "supporting structures", "decoration".

Popular programs:

- House. The basic set of risks includes a gas explosion, a lightning strike, the fall of aircraft, the entry of vehicles. The extended package includes the following risks: the gulf, natural disasters, third-party attacks.

- Flat. The following risks are insured: fire, gas explosion, gulf, natural disasters, force majeure, illegal actions.

7) Sberbank

The largest bank in our country. A company with state participation offers various services for insurance of residential real estate (apartments, houses).

The main product in the field of home insurance is home or apartment insurance "Home protection"

We examined only a few popular insurance companies that offer home insurance services.

Read the insurance contract in detail and carefully read the conditions and payments in the event of an insured event.

7. How to save on home insurance - TOP 5 tips

Protecting your home from potential risks is the primary goal of insurance. It is better to spend small funds on insurance to avoid major problems in the future.

To save your own money, while providing yourself with maximum protection, tips from professionals will help:

Tip 1. Insurance for individual programs

This type of insurance provides an opportunity to independently choose risks and the amount of payments on them. This allows you to take into account all the individual needs of the client.

The agent inspects the property on a personal visit, determines the real market value, this ensures adequate payment in the event of an insured event.

Tariffs for individual programs below averagedue to the fact that the number of risks included in the policy is directly related to the cost of insurance.

Tip 2. Protecting your own home

Agents, inspecting an apartment, private home ownership, cottage, pay attention to the presence of property protection systems. They include the presence of fire and burglar alarms, outdoor surveillance cameras, the presence of gratings on windows, the condition of fences and locking structures, etc.

Installation of security systems will require additional investment, but it will pay off, raise housing status. This will lead to a reduction in the tariff and with long-term insurance it will fully pay off.

Tip 3. Choosing Risks

The presence of certain insurance positions should be determined by the client independently. Inadvisable risks should be excluded from the package of services.

For example, if the house is far from the motorway, why insure it against the entry of another's vehicles?

For the effective distribution of risks, it is necessary to study information on the statistics of the onset of certain risks, the composition of a specific threat.

You can contact a professional (outsourcer), he will help calculate risk for each item that the policyholder is interested in, it will provide a choice of individual programs.

Tip 4. Determine the degree of participation of the policyholder in risk

The presence of a franchise in the contract saves the insured. In this case, the insurer is exempted from the payment of insurance compensation in a certain amount.

For example: In the event of an insured event for compensation for damage in 200 thousand rubles established franchise under the contract in the amount of 5 %. In this case, the insurance company pays only 190 thousand rubles, and the remaining 10 thousand rubles. paid by the policyholder from their own funds.

Tip 5. Use of short-term types of insurance

Short-term is a contract concluded for up to a year. According to statistics, the main time for the occurrence of insured events is summer, when the threat of fires, floods, thefts increases. This is due to the lack of hosts on vacation.

Minimize costs will allow holiday home insurance. In total terms, it will be cheaper than a long-term contract. It is necessary to include, in addition to the main risks, responsibility to neighbors.

8. 6 main mistakes-errors when insuring an apartment / house against fire, flooding, theft

Often, policyholders are mistaken in calculating insurance and at other times when drawing up an insurance contract for a private home. To avoid them, consider the most common mistakes of policyholders.

Error 1. The high cost of the policy

Customers who do not understand the intricacies of insurance believe that home insurance will cost significantly expensive apartments. Here the interweaving of two concepts takes place: titleand property insurance.

Title insurance is one of the most expensive types of contract, its value depends on the market value of the property.

When concluding a property insurance contract only, the amount will be significantly lower. The amount of the contract will be determined based on the estimated cost of restoration work.

Therefore, before the conclusion of the contract, all the conditions for its conclusion are analyzed, as far as title insurance is necessary when buying a new apartment or house.

We recommend reading an article about real estate investment, which described in detail the pros and cons of investing in real estate.

Also, the cost of the policy is affected by comprehensive home insurance, which is offered by insurers. The cost of insurance depends on the number of risks included in the contract.

Many companies offer various types of programs:

- Economical.

- Optimal.

- The maximum.

Mistake 2. Full insurance coverage for theft

A standard risk package includes structural damage and internal communications. If the client wants to insure the house against theft, this should be executed in a separate contract or be included in a comprehensive protection program.

Good to know!

In case of damage caused by the fault of the insured, the insurer has the right to refuse to pay insurance compensation.

Mistake 3. Home Insurance Protects Against Natural Disasters

This fact is undeniable in the case of inclusion in the pole of all types of natural disasters that can damage the home. Compensation will be paid only upon the occurrence of a specific incident in the policy.

If the house was insured against harm by a strong wind, but rainfall broke through the roof in the form of hail, no one will pay the damage.

Error 4.You can not insure land

The cost of a land plot, especially near a large city, is significant amounts, therefore this property can and should be secured.

The main risks are:

- Fire, explosion, accident communications.

- Earthquakes, floods, landslides.

- Soil pollution due to disasters or accidents.

- The fall of the aircraft.

- Illegal actions.

There are risks of washing off the fertile layer of the earth, damaging the landscape design. They are included in the policy if the insured wishes, which will guarantee compensation for damage upon the occurrence of an insured event.

The most significant risk is the loss of ownership of the land. According to statistics, land owners rarely resort to such a service. This is because the probability of occurrence of these events is not high.

Mistake 5. Home insurance fully protects against fire damage.

If, when applying for the policy, a professional assessment of the market value of a private home ownership was not made, the amount of payment will be calculated based on their replacement cost. This suggests that the amount paid by the company will not cover the cost of repairs 100%.

In addition, a cause of fire must be produced. If the house burned down due to negligence of the owners, there will be no payment. Therefore, even when the risk of fire protection is included in the policy, it is necessary to observe fire safety techniques and know exactly the terms of the insurance contract.

Mistake 6. Why insure a house, if you can provide protection for it yourself

You can put a modern alarm system, hang the grilles on the windows and connect strong lockable structures, you can hang video surveillance cameras in the house and in the section of the house, but give guarantees of complete safety of the home impossible.

For example, one cannot predict the entry into the house of another's motor vehicle, a fire from a wiring closure, natural disasters, etc.

Compensation for the consequences of certain cases can only insurance.

9. Frequently Asked Questions (FAQ) for Home Insurance

When deciding to insure an apartment, house, land, a lot of questions arise. Answers to the most popular of them are suggested below.

Question 1. What is title insurance of real estate?

Title insurance means protection against the risk of loss of title to real estate.

Title- This is a document that confirms the ownership. At the same time, it cannot be considered that any loss of title is an insured event.

For example, if property is lost in a fire, explosion, intentional destruction, title insurance will not compensate for the loss.

This type of insurance is mandatory when obtaining a mortgage, buying a home in the secondary market.

Often transactions for the purchase and sale of one apartment or house are repeatedIf the law was violated once in a chain, all subsequent transactions shall be deemed null and void. In this case, title insurance will help.

The main reasons for the loss of ownership include:

- Infringement of the rights of third parties (minors, legally incompetent, heirs, etc.).

- Conducting previous transactions in violation of the law.

- Ineligibility of the transaction.

- The fraudulent nature of the transaction.

The size of the transaction tariff is up to 1% from the insured amount.

Question 2. What to do when an insured event occurs?

When an insured event occurs, it is necessary to act immediately.

Key steps to take:

Step 1. Take measures to reduce damage (extinguish a fire, block water, etc.)

If possible, save and preserve the insured property so as not to worsen its condition.

Step 2. Notify emergency services

Urgently call emergency services:

- A single emergency call using a mobile phone is 112.

- In case of fire - 01, 101.

- In the explosion of domestic gas - 04, 104.

- In the event of a flood, breakdown of operational systems - a call to operational services - Housing Management Office, management company, HOA.

- In case of natural disasters - in the Ministry of Emergencies.

- In case of theft, vandalism - to law enforcement agencies.

- If the vehicle drove into the house - the traffic police.

- If necessary, an ambulance - 03, 103.

Step 3. Contact the insurance company

Within three days, contact the insurance company to notify of the occurrence of an insured event and receive advice on further actions. Collect all possible preliminary information about the damage.

Step 4. If possible, do not touch anything until the damage is recorded.

Until representatives of the insurance company arrived, do not touch anything (if possible).

Without the written consent of the insurer, it is impossible to give consent to the settlement of issues with voluntary compensation for losses by the guilty party.

It will be necessary to prepare an insurance contract, policy, receipt of payment of contributions, an identity document. It will also be necessary to collect certificates from the competent authorities confirming the occurrence of the event with confirmation of the amount of damage caused.

Question 3. From what does insurance cover an apartment, a country house, and so on?

It is impossible to completely protect your own home from unforeseen risks. Only insurance will help.

What insures an apartment, a country house and a summer cottage - the main risks

What insures an apartment, a country house and a summer cottage - the main risks

The main risks that insure companies are:

- Fire;

- Explosion;

- Flooding;

- Lightning strike;

- Destruction;

- Natural disasters, for example: hurricane, earthquake, flood, heavy rain, heavy snow;

- Theft, robbery, robbery;

- Deliberate destruction (damage to property) by other persons;

- Act of terrorism;

- Penetration into the apartment of liquids from other rooms not belonging to you;

- Other cases specified in the insurance rules depending on the selected insurance company.

You can choose several possible risks, or insure your home for all unforeseen circumstances, it all depends on the individual needs of the insured.

The companies offer different packages of services in which various risks are grouped, where unpopular risks can be included along with the necessary ones.

Question 4. How much does it cost to insure a house, apartment?

The cost of the service is individual, it depends on many factors: area, location, status of the premises, number of selected risks, choice of insurance company, etc.

The price of comprehensive home insurance begins from 1000 rubles. The cheapest is called the “Boxed Product." It includes a basic set of risks, its design will take a minimum of time. As a rule, insurance companies do not inspect property; you can issue a policy online.

When concluding a contract, it should be understood that the largest share in insurance compensation is protection of load-bearing walls.

Finishing, which has a higher risk of damage, occupies only 10% of the total contract amount.

Under individual insurance conditions, the cost of the service is:

- Finishing and property - 03-, 3-0.7% of the sum insured.

- House - 0.2-1.0% of the sum insured.

The table of the average cost of insurance when taking into account the basic risks:

| The minimum cost of the annual policy (thousand rubles) | 2 | 2,3 | 2,9 | 3,8 | 5,9 |

| Finishing (500 thousand rubles) | + | + | + | + | + |

| Bearing structures (300 thousand rubles) | - | + | + | + | + |

| Civil liability (300 thousand rubles) | - | - | - | - | + |

10. Conclusion + video on the topic

Living in an insured house, apartment is much calmer, this will save not only money, but also nerves. It will save you from possible cash costs and troubles.

In conclusion, we recommend watching a video about insurance of a country house (cottage) -

It is important to take into account your own interests and needs, choose the right insurance company, carefully study the contract and policy, and do not forget about paying insurance premiums.

Questions to readers

Do you insure your housing (apartment, cottage, cottage)? If so, under what conditions?

Dear readers of the Rich Pro website, if you still have questions about insurance of an apartment, home or other residential real estate or you want to share your opinion and personal experience, leave your comments below!